| StockFetcher Forums · General Discussion · Is this a crash or a correction? | << 1 ... 12 13 14 15 16 ... 22 >>Post Follow-up |

| karennma 8,057 posts msg #145578 - Ignore karennma |

12/15/2018 12:50:19 PM chart 57? Yeah, I know. Posting LATE as usual. They should've told people this sh*+ 2 months ago. Here's what I said TWO MONTHS AGO ... Xxxxxxxxx 1,710 posts msg #144939 - Ignore Xxxxxxxx 10/12/2018 1:09:35 PM I like what Kudlow had to say this morning. Its a normal correction in a Bull Market. ============================== karennma 7,147 posts msg #144968 10/16/2018 10:36:01 AM But did you also hear the precursor to Kudlow's statement? He said, "Liz Ann Sonders knows more than I" .... LAS said this is the tail END of the bull market. No sh*!+!! Yep. Liza Ann Sonders knows and here's what she had to say this week -- ... You were warned two months ago! |

| Cheese 1,374 posts msg #145579 - Ignore Cheese |

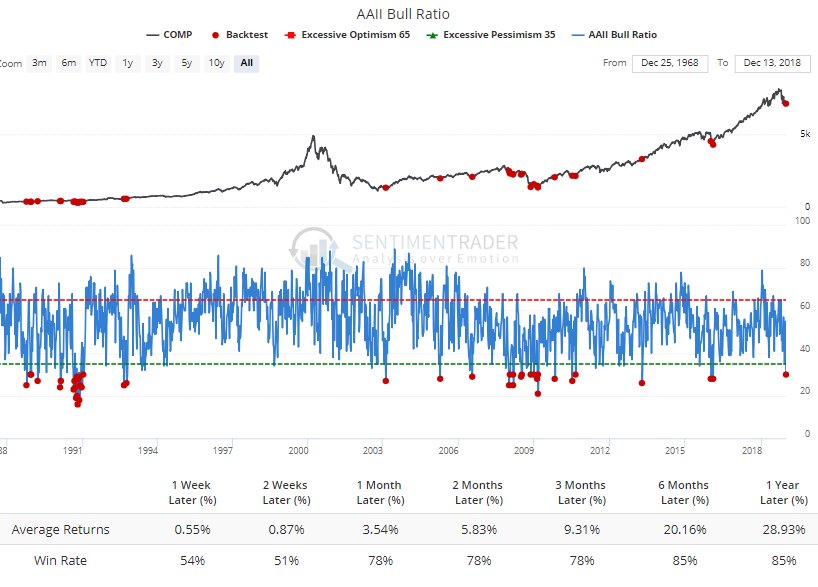

12/15/2018 8:12:17 PM @karennma On Dec 13, 2018 Liz Ann Sonders @LizAnnSonders re-tweeted the following from SentimenTrader @sentimentrader According to the Backtester, when Ma & Pa have gotten this despondent, tech stocks rallied an average of 29% over the next year.

Previously, on Apr 12, 2018 LAS re-tweeted the following from SentimenTrader @sentimentrader This is what happens when mom & pop become pessimistic during an uptrending market.

So, if we were to believe the above Dec 13 tweet and re-tweet, we could see higher levels for tech stocks in Dec 2019, higher than the current correction levels of Dec 2018. Better yet, if we were to believe the above Apr 12 tweet and re-tweet, we could see higher levels for tech stocks in Apr 2019 that could be higher than the high levels of Apr 2018 (higher than the correction levels of Dec 2018.) Maybe we could believe in the American spirit and tech innovation, and watch for a bottoming process amidst a thousand points of lights. |

| snappyfrog 749 posts msg #145580 - Ignore snappyfrog |

12/16/2018 9:14:19 AM As a swing and options trader, this volatility is great. Stocks and ETFs swing up and down every day, week and month. I don't short stocks, but I do play inverse ETFs along with playing options in both directions. There are always plays available every day. Do I take losses, absolutely. But, even in a down market there are numerous ways to make money. |

| karennma 8,057 posts msg #145581 - Ignore karennma |

12/16/2018 9:24:11 AM @ Cheese, Re: "According to the Backtester, when Ma & Pa have gotten this despondent, tech stocks rallied an average of 29% over the next year." =================================================================================== Some will, some won't. Back in 2000, techies like CSCO, INTC, YHOO, and MSTR rallied, but not back to their highs. "Ma & Pa" were still holding and hoping. Ever heard of RMBS?? RMBS is $8. It used to be $600. I remember one of my co-workers joyfully telling me in 2012, that her 401K was back to where it was before the 2008 crash. The problem is, if your portfolio drops 30% and then rallies 29% a year later, you're flat. And re: the "despondence" ... I'd rather stay in cash and avoid more stress and sadness. Like I said, when losing money becomes the hobby, it's time to quit. Better for me to be in the peanut gallery watching the show than holding long positions in a bear market. Honestly, it's all an individual thing. I'm not saying everyone should do this. Based on my experience, this is JMHO. |

| Cheese 1,374 posts msg #145582 - Ignore Cheese |

12/16/2018 11:15:37 AM @karennma I am with you, and of course I respect everyone's personal decisions. From reading your posts over the years, I've known you as a very smart businesswoman. I hope you will keep posting. Thank you. |

| nibor100 1,096 posts msg #145583 - Ignore nibor100 |

12/16/2018 11:59:30 AM Unfortunately for all of us, a portfolio that drops 30% and gains 29% the following year will still be down -9.7%. It would require an addditional gain of 10.7% to get back to its starting portfolio value due to the math of percentages of larger numbers vs. the % of smaller numbers. Ed S. |

| nibor100 1,096 posts msg #145584 - Ignore nibor100 |

12/16/2018 12:46:13 PM @cheese, I'm not familiar with that/those charts so I have a few questions if you don't mind: 1. Both charts are entitled "AAII Bull Ratio" but the black data line in the upper backtest chart is labeled 'Comp' and in the lower chart its the SPX. Do you know if the Comparison stock she used for the backtest was also the SPX? 2. Do you know if the 31 red dots in the lower area of the upper chart are anyhow related to the 73 dates since 1986, cited at the beginning of the table at the bottom of the 2nd chart? 3. Is the green line that points to a green box on the 2nd chart your drawings or hers? Very interesting stuff, Thanks, Ed S. |

| karennma 8,057 posts msg #145585 - Ignore karennma |

12/16/2018 2:02:58 PM nibor100 213 posts msg #145583 - Ignore nibor100 12/16/2018 11:59:30 AM Unfortunately for all of us, a portfolio that drops 30% and gains 29% the following year will still be down -9.7%. It would require an addditional gain of 10.7% to get back to its starting portfolio value due to the math of percentages of larger numbers vs. the % of smaller numbers. Ed S. ================================================= Many years ago, I read quite a few articles about this and it's true. If my co-worker had calculated correctly, she was actually still down by a substantial amount. But people play all kinds of games w/ numbers to make themselves feel better. |

| Cheese 1,374 posts msg #145588 - Ignore Cheese |

12/16/2018 4:36:46 PM @nibor100 Hi Ed, I was just trying to comfort karennma by reporting another point of view from the same expert Liz-Ann Sonders. I did not make any changes to the original charts and tweets, and I don't have additional information. Nobody knows the future but some of the markets did seem to go up after the Apr 12, 2018 tweets You may want to contact and get more info from the authors, here: https://twitter.com/sentimentrader sentimentrader.com https://twitter.com/LizAnnSonders https://twitter.com/ann_sonders Schwab.com Good luck trading, and thanks again for some of the helpful info you gave to the forum in the past. |

| karennma 8,057 posts msg #145590 - Ignore karennma |

12/17/2018 7:22:41 AM Cheese 237 posts msg #145588 - Cheese 12/16/2018 4:36:46 PM @nibor100 Hi Ed, I was just trying to comfort karennma by reporting another point of view from the same expert Liz-Ann Sonders. Nobody knows the future but some of the markets did seem to go up after the Apr 12, 2018 tweets ======================================================================= @ Cheese, "Nobody knows the future" - If you're old enuf and have been watching the market long enuf ... I could see this sh*+ coming a mile away. It started looking like 2000 & 2008. Of course the market went up after 4-12-18 .. that was the rebound and the grand finale. Breaching the 200 DMA was the warning. I posted the info but few here paid attention. @ Cheese, I appreciate your kind, encouraging words .. but they're not going to help me. My position was clear. I made it clear when I posted this in MARCH 2018: THIS is my LAST Warning .... << 1 2 >>Post Follow-up karennma 7,150 posts msg #142949 3/28/2018 10:58:58 AM You're on the Titanic. karennma 7,150 posts msg #142950 modified 3/28/2018 11:01:23 AM This ship has been sinking slowly since JANUARY 2018 when everything was in double & triple tops. Gary Cohn leaving his WH post was just the tip of the iceberg. karennma 7,150 posts msg #142951 3/28/2018 11:06:22 AM How come my software is not showing 1/2 my holdings as "oversold"? Because they're going LOWER. 4/8/2018 8:35:04 PM karennma 7,034 posts msg #142950 modified 3/28/2018 11:01:23 AM This ship has been sinking slowly since JANUARY 2018 when everything was in double & triple tops. Gary Cohn leaving his WH post was just the tip of the iceberg. ================================= Fotchstecker, I already told you ... "everything was in double & triple tops in JANUARY." Not only that, but frankly, once things start "touching" the 200 DMA, I get uncomfortable. Some people think that's a "dip". I don't. Next time, we might be below the 200 DMA. This is just my opinion. If you don't agree, that's fine. A LOT of peeps here don't agree w/ me. It's no big deal. Read it or leave it. I think everyone here knows what's going on w/ China, interest rates and bonds. If you want to post economic data, feel free to do so. I've read a ton of "economic data" this week-end and I've drawn my own conclusions. For me personally, at this juncture, there are only two positions - either short or out (all cash). GLTY! I've posted economic data. I started a thread on a "Housing Market" decline 3 months ago. Cheese, it appears, you were the only one who looked at it. So, in a nutshell, at the present time, I don't give a rat's @$$ about all those fancy charts that peeps post AFTER-THE-FACT. If their charts know so much, why didn't their charts tell them in March, "look out below" .... Telling the peanut gallery in December doesn't do most people any good. Here are Liz Sonders' LATEST WORDS, 24 hours ago on TWTR (which, BTW has not crashed) ... "this is how downtrending markets behave. It's a composite of the 20 bear markets since 1950." I only have ONE thing to say ... No $#*+! I cudda told you that 9 months ago ... And I did! |

| StockFetcher Forums · General Discussion · Is this a crash or a correction? | << 1 ... 12 13 14 15 16 ... 22 >>Post Follow-up |